Recently, the #Solana Foundation caused a stir in its community by removing several node operators from its network. Why did they take this action?

The decision revolves around MEV (Maximum Extractable Value) practices and the so-called "sandwich attacks," which we will be discussing today.

A MEV occurs when node operators exploit validation mechanisms to profit more from each transaction they confirm.

“Front-running” is a common form of attack. By rearranging the block, the validator may collect the fees of failed transactions. They can also front-run by offering higher gas fees and buying assets before another person.

This form of attack usually escalates to a “sandwich attack”. This is, by forcing a transaction before and after a regular user trade, the attacker can profit from the artificial price movement they created.

For example, imagine someone is trading 1,000 USDT for 1ETH (good old times…):

- The attacker buys 1 ETH before the user's transaction is confirmed with 1,000 USDT (front-running).

- The victim’s trade makes ETH's price increase, and the exchange rate is now 2000 USDT:1 ETH.

- The attacker now can sell 1 ETH for 2000 USDT (back-running), making a 100% profit.

While oversimplified, these examples clearly show how these practices can be harmful, since the attacker’s trade also changes the original price by artificial supply and demand.

The use of bots for MEV attacks has been so detrimental for the everyday user that it has transitioned from an "if" scenario to a "when" inevitability:

By spamming transactions through bots, they cause network congestion.

They force victims to pay higher prices for assets due to artificial price increases.

For this, some blockchains seek to mitigate such attacks by removing financial incentives from nodes that engage in these practices.

It's important to note that the possibility of MEV attacks and the use of bots depend greatly on the network's infrastructure and features.

Some networks, like #Ripple, utilize blockchain technologies to achieve rapid and secure transactions. In this case, the XRP system is operated by handpicked nodes selected by a private company, Ripple Labs.

This model allows better control over who operates, reducing the probability of malicious attacks. However, it's a more centralized approach, which deviates from the decentralized essence that underpins crypto.

Some users argue that efforts to address the MEV problem may result in even worse information latency. Others reference the blockchain trilemma, suggesting it might be a necessary trade-off.

What's your opinion? Is a more centralized approach like XRP a good solution, or is there a better alternative?

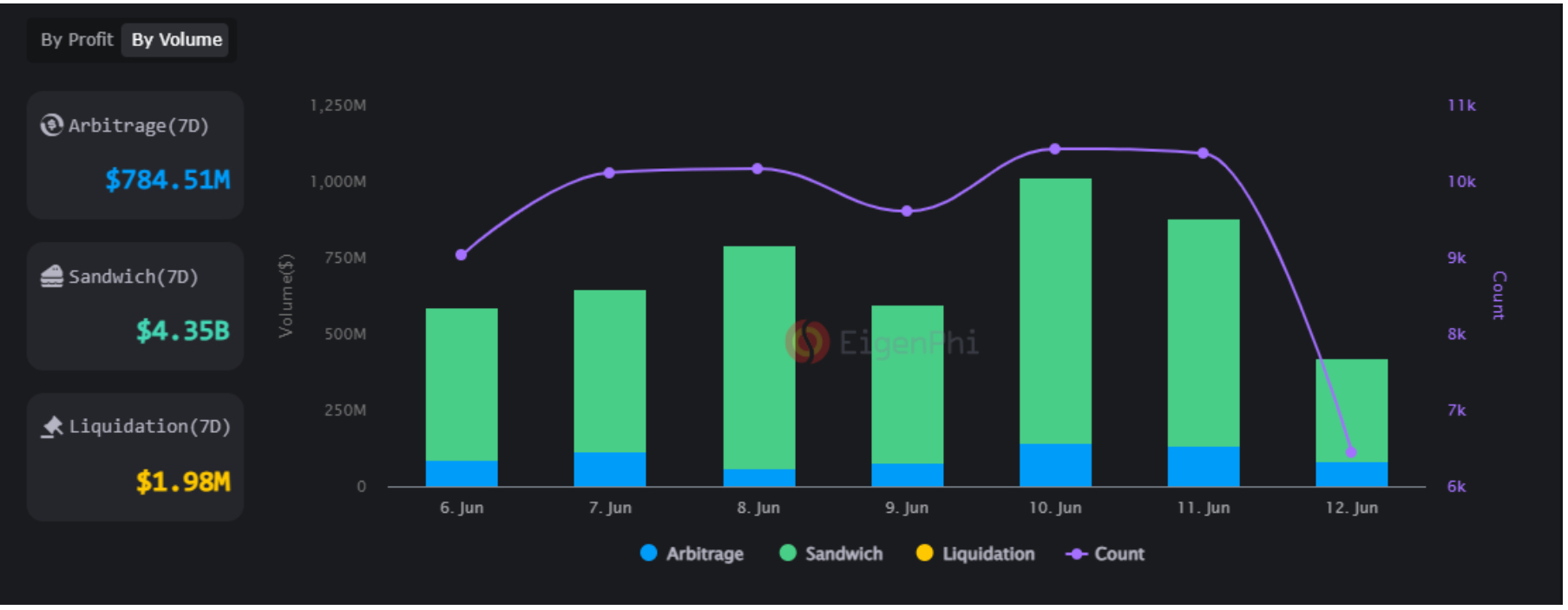

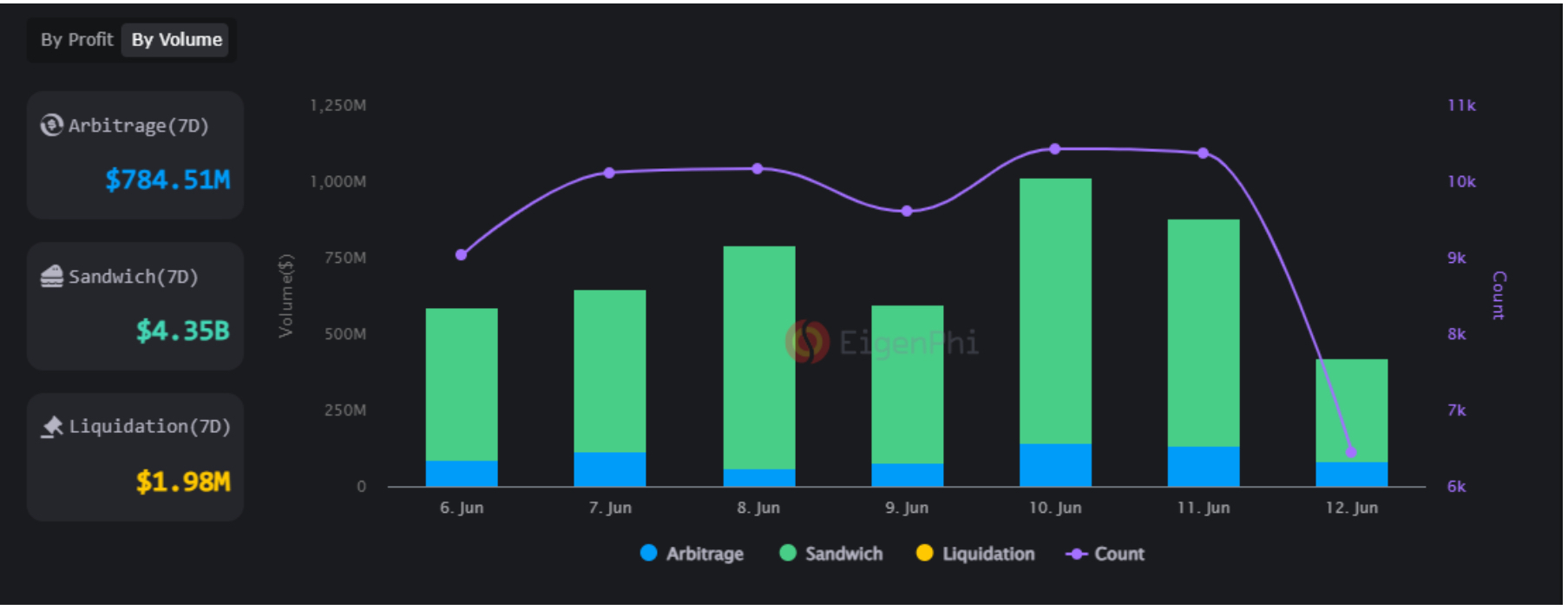

For your interest, sandwich attacks moved about $USD 4.35B on all chains in the last week, according to EigenPhi (MEV Data | EigenPhi|Wisdom of DeFi).